The Biggest Issue Facing Housing Next Year

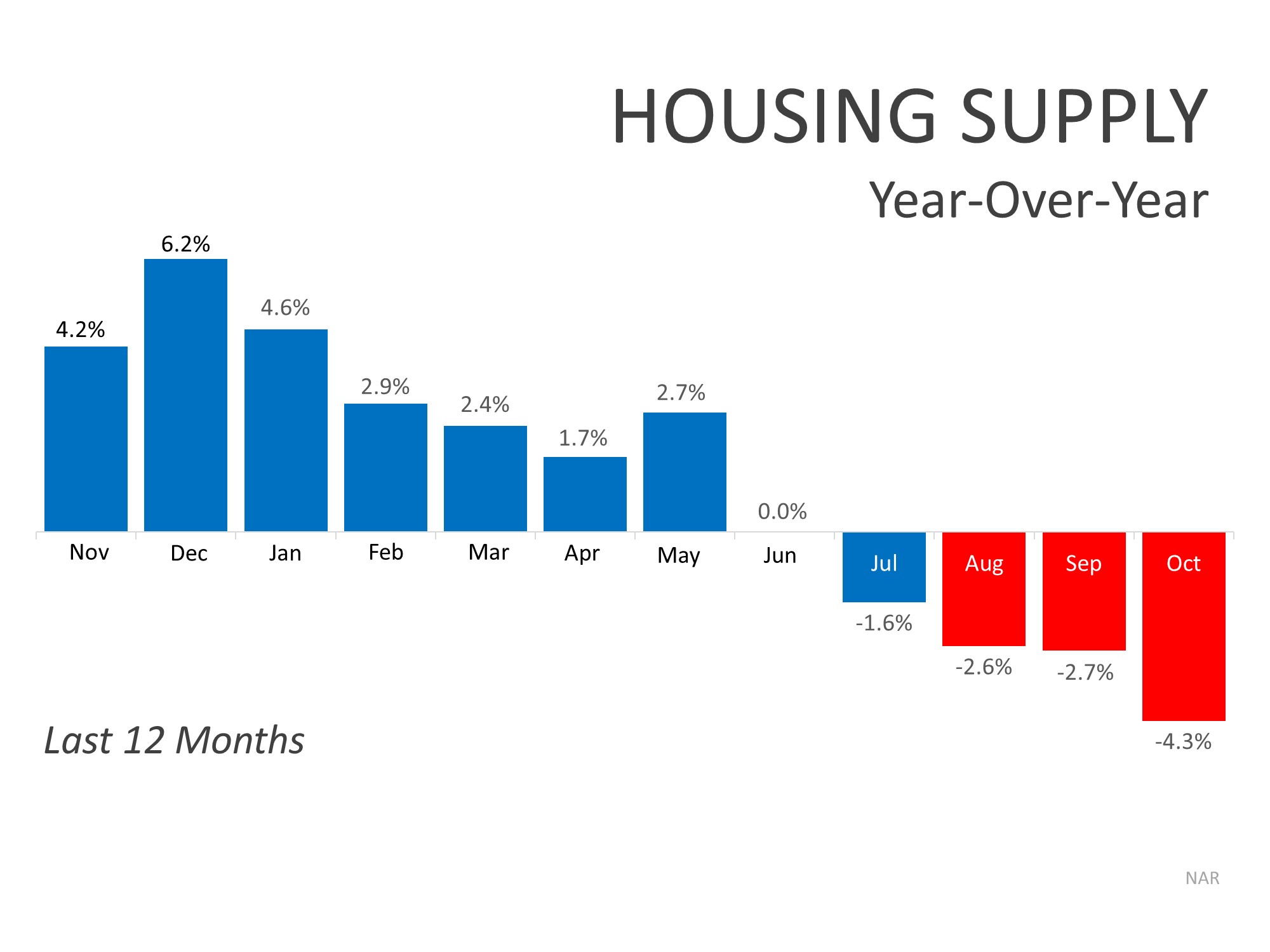

This coming year the housing market will be defined by 3 things- inventory, interest rates, and appreciation. But the biggest issue the housing market will face in 2020 is an inventory shortage. There aren’t enough homes on the market for buyers, especially on the lower end of the market. This is a topic that has come up frequently within the past several months.

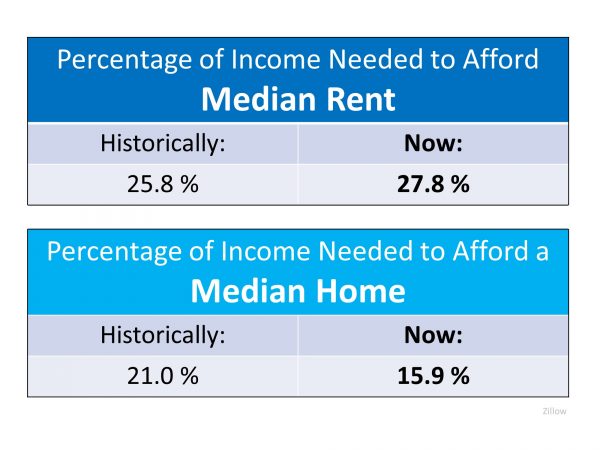

Based on what is forecasted, we know that interest rates are projected to remain low and that appreciation is expected to continue as we move into 2020. Additionally, the upcoming election will provoke many unique perspectives on the health of the US housing market. The challenge will be understanding what is actually happening and how you can best position yourself if you are thinking of buying or selling your home.

Here are several perspectives to consider on the inventory issue facing housing next year:

According to realtor.com:

“Despite increases in new construction, next year will once again fail to bring a solution to the inventory shortage that has plagued the housing market since 2015. Inventory could reach a historic low as a steady flow of demand, especially for entry level homes, and declining seller sentiment combine to keep a lid on sales transactions.”

Diana Olick at CNBC:

“Inventory has been falling annually for five straight months, after it recovered slightly toward the end of last year, due to a spike in mortgage rates. Rates began falling again by spring of this year. Homebuilders have been increasing production slowly, but it’s not enough to meet the increasingly strong demand.”

George Ratiu, Senior Economist with realtor.com

“As millennials — the largest cohort of buyers in U.S. history — embrace homeownership and take advantage of this year’s unexpectedly low mortgage rates, demand is outstripping supply, causing inventory to vanish. The housing shortage is felt acutely at the entry-level of the market, where most millennials are looking to break into the market for their first home.”

Bottom Line

The most important thing you can do is understand what is happening in your local market. You may not be able to avoid some of the issues brought on by low inventory, but you can be educated and prepared. Let’s connect and discuss the options that make the most sense for you and your family.

![The Cost Across Time [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/11/21055835/20191122-MEM-1046x808.jpg)