Will the Housing Market Bloom This Spring?

Spring is almost here, and many are wondering what it will bring for the housing market. Even though the pandemic continues on, it’s certain to be very different from the spring we experienced at this time last year. Here’s what a few industry experts have to say about the housing market and how it will bloom this season.

Danielle Hale, Chief Economist, realtor.com:

“Despite early weakness, we expect to see new listings grow in March and April as they traditionally do heading into spring, and last year’s extraordinarily low new listings comparison point will mean year over year gains. One other potential bright spot for would-be homebuyers, new construction, which has risen at a year over year pace of 20% or more for the last few months, will provide additional for-sale inventory relief.”

Ali Wolf, Chief Economist, Zonda:

“Some people will feel comfortable listing their home during the first half of 2021. Others will want to wait until the vaccines are widely distributed. This suggests more inventory will be for sale in late 2021 and into the spring selling season in 2022.”

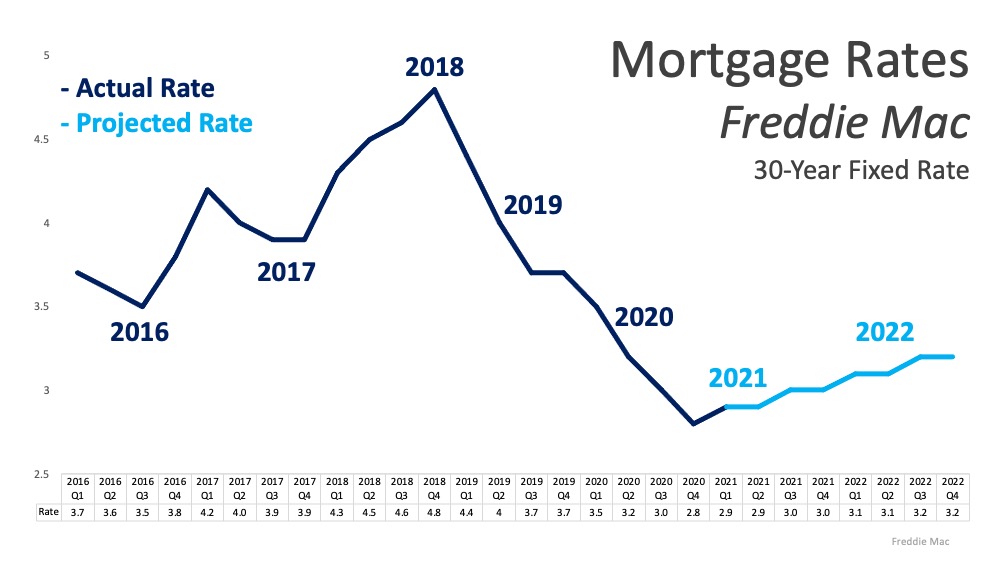

Freddie Mac:

“Since reaching a low point in January, mortgage rates have risen by more than 30 basis points… However, the rise in mortgage rates over the next couple of months is likely to be more muted in comparison to the last few weeks, and we expect a strong spring sales season.”

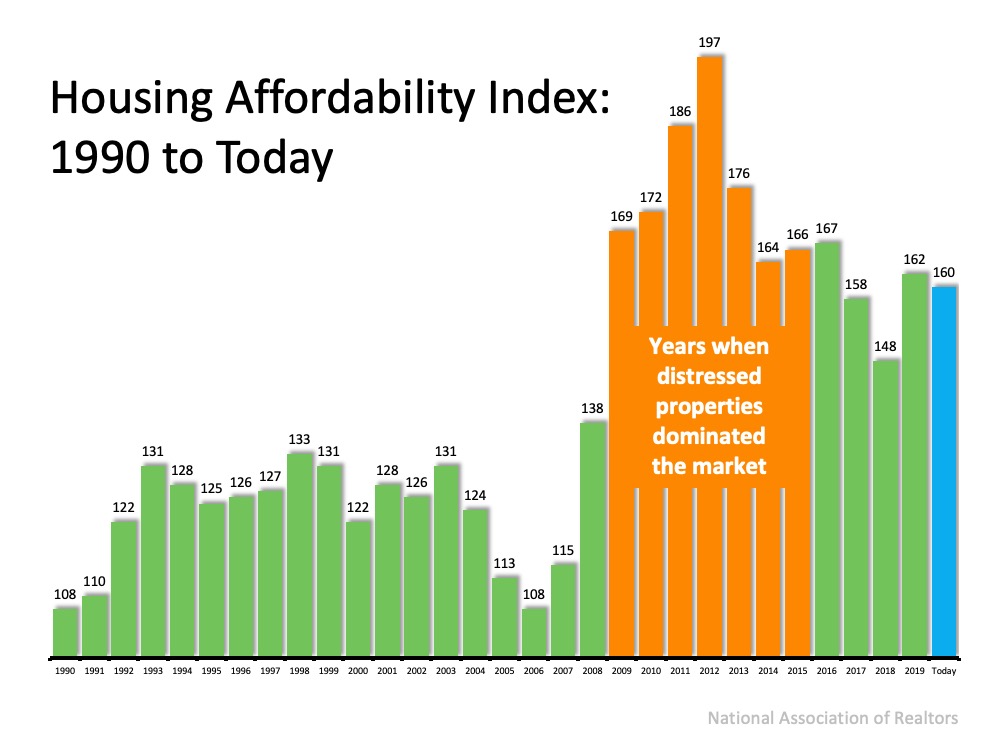

Mark Fleming, Chief Economist, First American:

“As the housing market heads into the spring home buying season, the ongoing supply and demand imbalance all but assures more house price growth…Many find it hard to believe, but housing is actually undervalued in most markets and the gap between house-buying power and sale prices indicates there’s room for further house price growth in the months to come.”

Bottom Line

The experts are very optimistic about the housing market right now. If you pressed pause on your real estate plans over the winter, let’s chat to determine how you can re-engage in the homebuying process this spring.

Whether you’re buying your first home or selling your current house, if your needs are changing and you think you need to move, the decision can be complicated. You may have to take personal or professional considerations into account, and only you can judge what impact those factors should have on your desire to move.

Whether you’re buying your first home or selling your current house, if your needs are changing and you think you need to move, the decision can be complicated. You may have to take personal or professional considerations into account, and only you can judge what impact those factors should have on your desire to move.