Homeownership is on the goal list for many young adults, but sometimes it’s hard to know exactly how to get there. From understanding the homebuying process to pre-approval and down payment assistance options, uncertainty along the way can ultimately hold some buyers back.

Today, there are over 75 million Millennials and 67 million Gen Z’ers in the U.S., making up a significant number of both current and soon-to-be homebuyers. According to a recent Fannie Mae survey of more than 2,000 of these individuals:

“88% said they are confident they will achieve homeownership someday.”

In addition, the survey also reveals that for younger generations, the motivation to own a home may be more emotional than financial compared to previous generations:

- <50% say they want to use their home as an asset

- 78% believe it’s the best way to live the way they want, without restrictions

- 80% believe homeownership is the best way to make it on their own

Whether homeownership goals come from the heart or are driven by financial aspirations (or maybe both), the obstacles standing in the way don’t have to bring these dreams to a screeching halt. The same survey also reveals two key roadblocks for potential buyers. Thankfully, they’re both easily overcome with the power of knowledge and trusted advisors leading the way. Here’s a look at these two challenges potential homebuyers face today:

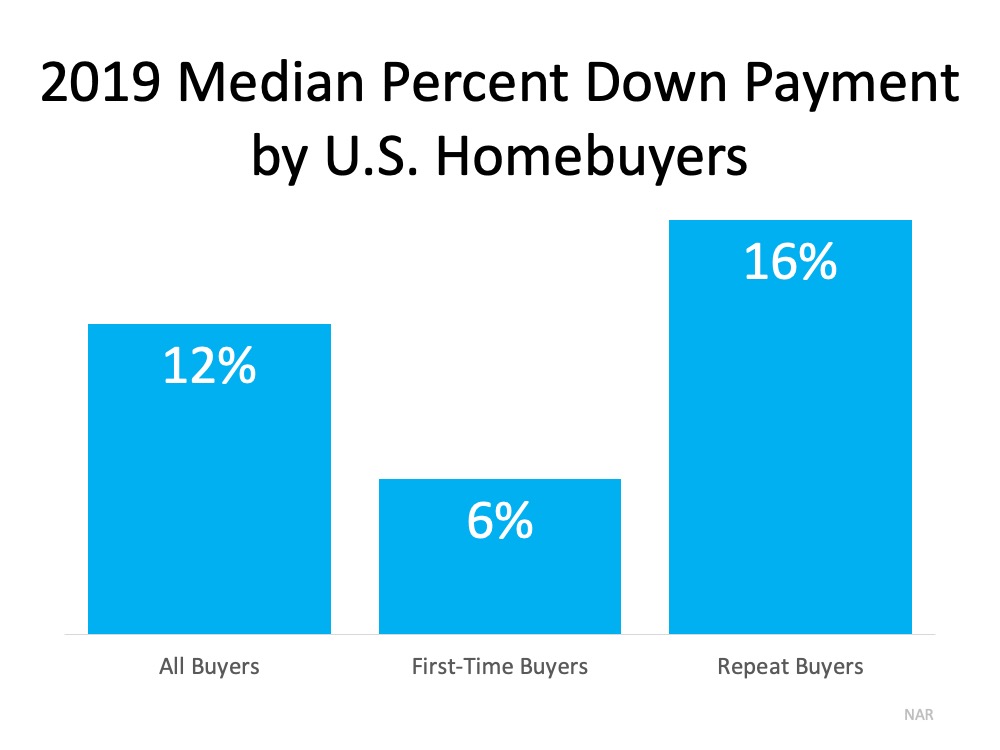

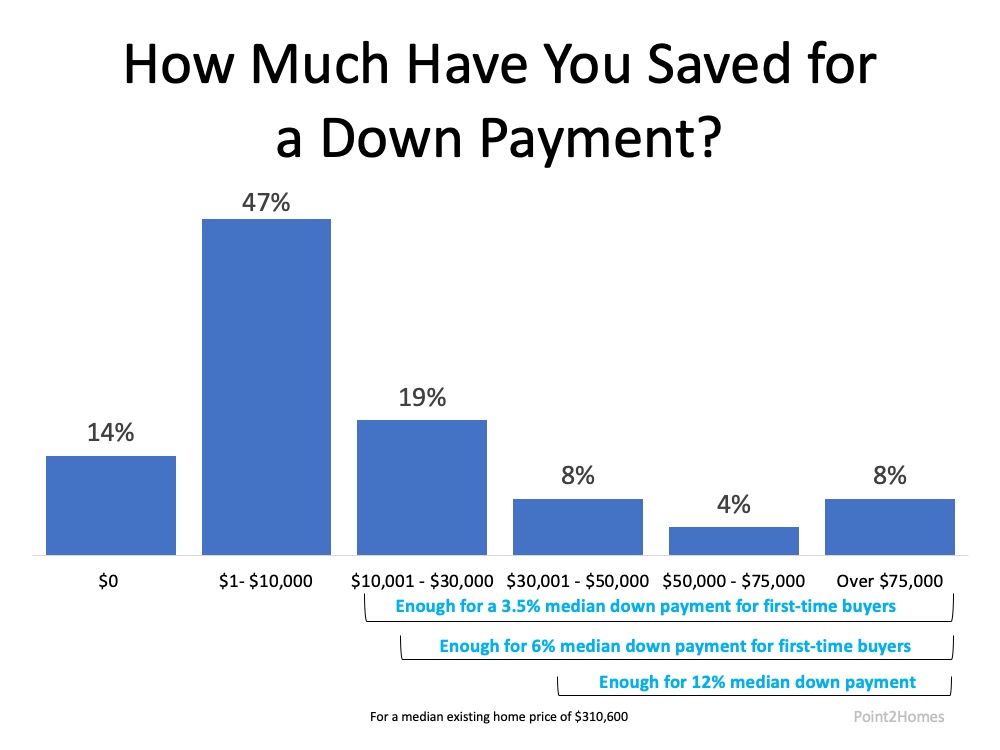

1. 73% of future homebuyers are unaware of low-down-payment mortgage options

For those who want to purchase a home, low-down-payment options are instrumental to affording one sooner rather than later, especially given the amount of debt many younger adults have accumulated. Fannie Mae also notes:

“Among the challenges they face is an unprecedented amount of debt, along with a lack of understanding of the mortgage process and their own purchasing power. Debt, in particular, creates many obstacles such as a limited ability to save and the fear of taking on more debt.”

Today, there are more than 2,340 down payment assistance programs available nationwide to help relieve this pressure. Understanding what’s out there and the options available may help many buyers become homeowners faster than they thought possible. In a year like this, with record-low mortgage rates making their mark in the history books, being able to take advantage of the opportunity buyers have right now is essential to long-term affordability.

2. 64% of buyers expect lenders and other real estate professionals to educate them about the mortgage process

While many people love to do a quick search online to find instant answers to their questions, it isn’t the only way younger generations want to consume information or build their knowledge base. As the survey mentions, having trusted professionals help them learn what it takes to achieve their dreams is definitely on their wish list too.

Bottom Line

If you’re aiming for homeownership someday, it may be in closer reach than you think. Let’s connect so you can learn about the process and get the guidance you need to make it happen.

![What’s Causing Today’s Competitive Real Estate Market? [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/10/07124832/20211008-MEM-1046x2072.png)

![Multigenerational Housing Is Gaining Momentum [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/04/08105653/20210319-MEM-1046x1980.png)