The Grandparent Wish of Wanting To Move Closer to Grandchildren

Recent data shows grandparents want to move closer to their grandchildren. Let’s connect if you want to move to be closer to your loved ones.

Recent data shows grandparents want to move closer to their grandchildren. Let’s connect if you want to move to be closer to your loved ones.

During the pandemic, many people distanced themselves from their loved ones for health reasons. Grandparents were told to stay away from their grandkids, especially as schools started to open. That’s because it would have been risky to visit with their grandchildren who may have gotten sick from school.

Now that the pandemic has passed, many grandparents want more than ever to be near their grandchildren again to make up for that lost time. But how are they getting that “Grandparent Wish?” The data tells us many are moving to make sure they’re getting more quality time.

Recent data from the National Association of Realtors (NAR) shows people between the ages of 55 and 74 are moving farther (more than 100 miles) than any other age group (see graph below):

The average age of grandparents in the U.S. is 67 years. The logical leap is that at least some of the people who are moving the furthest are grandparents. But what’s causing them to move so far?

The same report from NAR shows the top reason people move is to be closer to loved ones (see graph below):

Based on this data, it’s fair to say many grandparents are getting their wish of more quality time with their grandchildren by moving to be closer to them. And after experiencing isolation and loneliness during the COVID pandemic, that’s an especially good thing.

If you’re a grandparent, you know how important your grandchildren are. And you may be willing to sell and move just to be closer by. As Vance Cariaga, a journalist at Go Bank Rates, explains:

“Never underestimate the power of grandchildren – especially when it comes to lifestyle and financial decisions. Recent data shows that many baby boomers are relocating further away from home than they used to so they can be closer to their grandbabies.”

The data shows grandparents are moving further to be near their grandchildren. If you have grandchildren of your own, maybe you can relate. When you decide it’s time to be closer to your loved ones, let’s connect.

Life events can have a major impact on what you need from your home, and retirement is one of the biggest changes many of us face. This period of your life can mean doing more of the things you enjoy, like traveling, visiting with loved ones, or taking on new hobbies. But what does that mean for your home?

If you’re looking for ways to focus more on the important things in your life, the answer could be downsizing. A recent article from The Balance talks about why it could be a great option, saying:

“There are many reasons to buy a smaller home—or to downsize from your present home—but sometimes, the idea that “less is more” is what propels homeowners to buy a smaller home.”

The 2022 Home Buyers and Sellers Generational Trends from the National Association of Realtors (NAR) provides more information on why people of retirement age choose to move. It shows the need for a smaller home, the desire to be closer to loved ones, and retirement itself as three of the top reasons homebuyers over the age of 55 make a move.

If you’re in this group, changing priorities may be top of mind for you today, and that could be driving your decision to downsize. After all, as your lifestyle changes, what you need in your home likely changes, too.

Plus, as The Balance notes, moving into a smaller home can open your schedule up even more. When you downsize, you can spend less time maintaining your home and more time with the people you love or exploring newfound hobbies. That’s a recipe that can lead to less stress and increased happiness.

Home equity plays a big role when you sell your existing house and move. It could be a great tool to use to help you downsize. According to the latest Homeowner Equity Insights report from CoreLogic, the average homeowner gained about $55,300 in equity over the past 12 months. Dr. Frank Nothaft, Chief Economist at CoreLogic, explains how important price appreciation and equity gains are for existing homeowners:

“Home prices rose 18% during 2021 in the CoreLogic Home Price Index, the largest annual gain recorded in its 45-year history, generating a big increase in home equity wealth, . . . For low- and moderate-income homeowners, home equity has historically been a major source of wealth.”

As home prices rise, your equity does, too. So, you may have more equity than you realize because of the record levels of home price appreciation over the past year. Those equity gains could allow you to make a larger down payment on your next home. And putting more money down can lead to a smaller monthly mortgage payment, which can give you greater financial freedom. It can also be a significant help in navigating today’s competitive housing market, since offering more money up front could help your offer stand out.

Whatever your homeownership goals are, a trusted real estate advisor can help you to find the best option for your situation. They’ll help you sell your current home and guide you as you buy your next one and enter this new phase of life.

If you’ve recently retired or plan to soon, your needs are likely changing. That means now may be the perfect time to downsize. Let’s connect so we can work together to find a home that matches your situation.

![Multigenerational Housing Is Gaining Momentum [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/04/08105653/20210319-MEM-1046x1980.png)

Did you know that 1 in 6 Americans currently live in a multigenerational household?

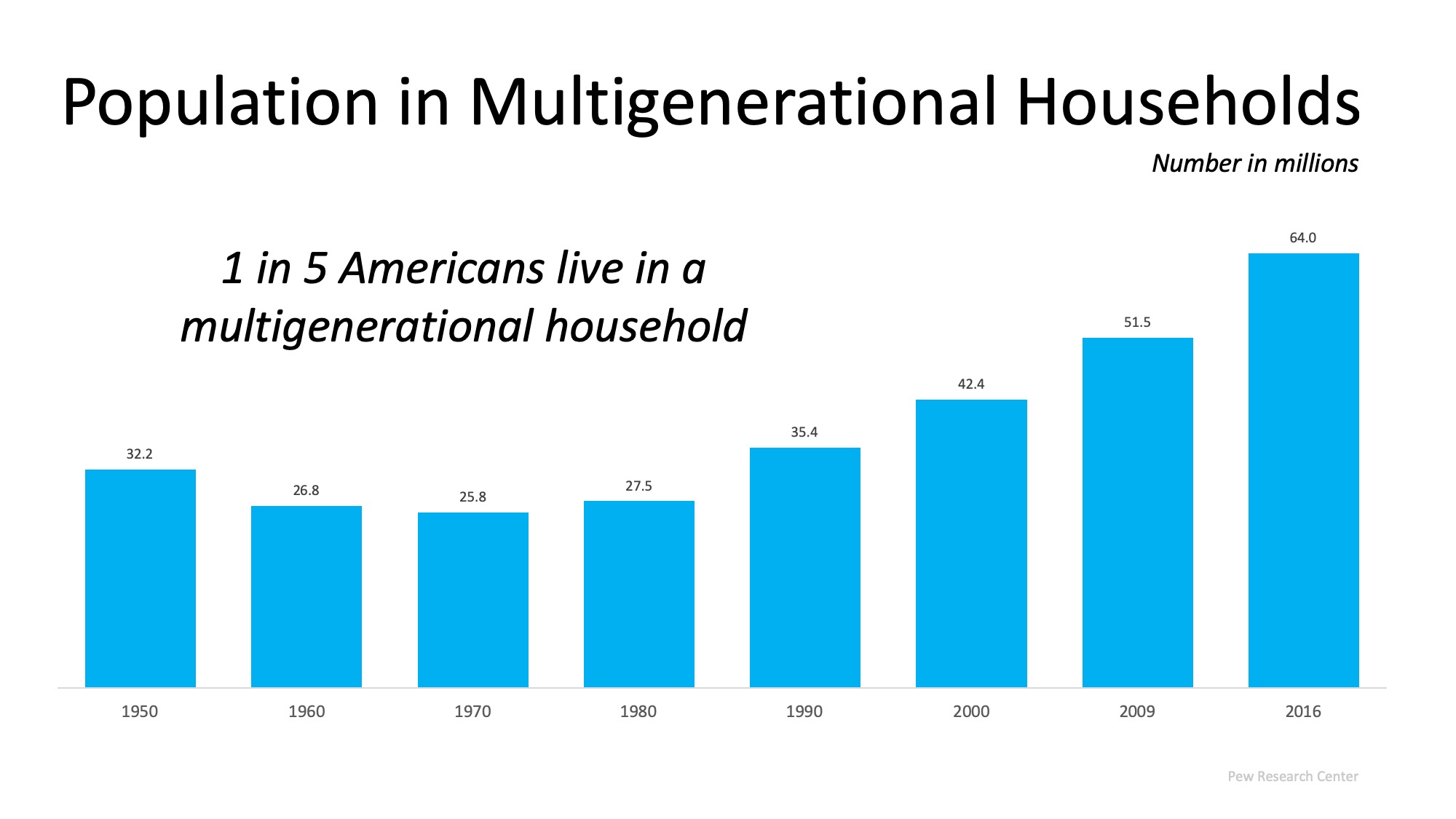

According to Generations United, the number of multigenerational households rose from 42.4 million in 2000 to 64 million in 2016. The 2018 Profile of Home Buyers and Sellers from the National Association of Realtors shows that 12% of all buyers have a multigenerational household.

The benefits to multigenerational living are significant. According to Toll Brothers,

“In recent years, there’s been a steady rise in the number of multigenerational homes in America. Homeowners and their families are discovering new ways to get the most out of home with choices that fit the many facets of their lives.”

The piece continues to explain the top 5 benefits of multigenerational living. Here is the list, and a small excerpt from their article:

1. Shared Expenses

“…Maintaining two households is undeniably costlier and more rigorous than sharing the responsibilities of one. By bringing family members and resources together under one roof, families can collectively address their expenses and allocate finances accordingly.”

2. Shared Responsibilities

“Distributing chores and age-appropriate responsibilities amongst family members is a tremendous way of ensuring that everyone does their part. For younger, more able-bodied members, physical work such as mowing the lawn or moving furniture is a nice trade-off so that the older generation can focus on less physically demanding tasks.”

3. Strengthened Family Bond

“While most families come together on special occasions, multigenerational families have the luxury of seeing each other every day. By living under one roof, these families develop a high level of attachment and closeness.”

4. Ensured Family Safety

“With multiple generations under one roof, a home is rarely ever left unoccupied for long, and living with other family members increases the chances that someone is present to assist elderly family members should they have an accident.”

5. Privacy

“One of the primary trepidations families face when shifting their lifestyle is the fear of losing privacy. With so many heads under one roof, it can feel like there’s no place to turn for solitude. Yet, these floor plans are designed to ensure that every family member can have quiet time… [and] allow for complete separation between the generations within the household.”

The trend of multigenerational living is growing, and the benefits to families who choose this option are significant. If you’re considering a multigenerational home, let’s get together to discuss the options available in our area.

As loved ones start to get older, we start to wonder: how long will they be able to live alone? Will they need someone there to help them with daily life? There’s a reason to ask those questions now more than ever, as the average life expectancy in the U.S. is 78 years old! As a result, 41% of Americans in the market are searching for a home that can accommodate a multigenerational family.

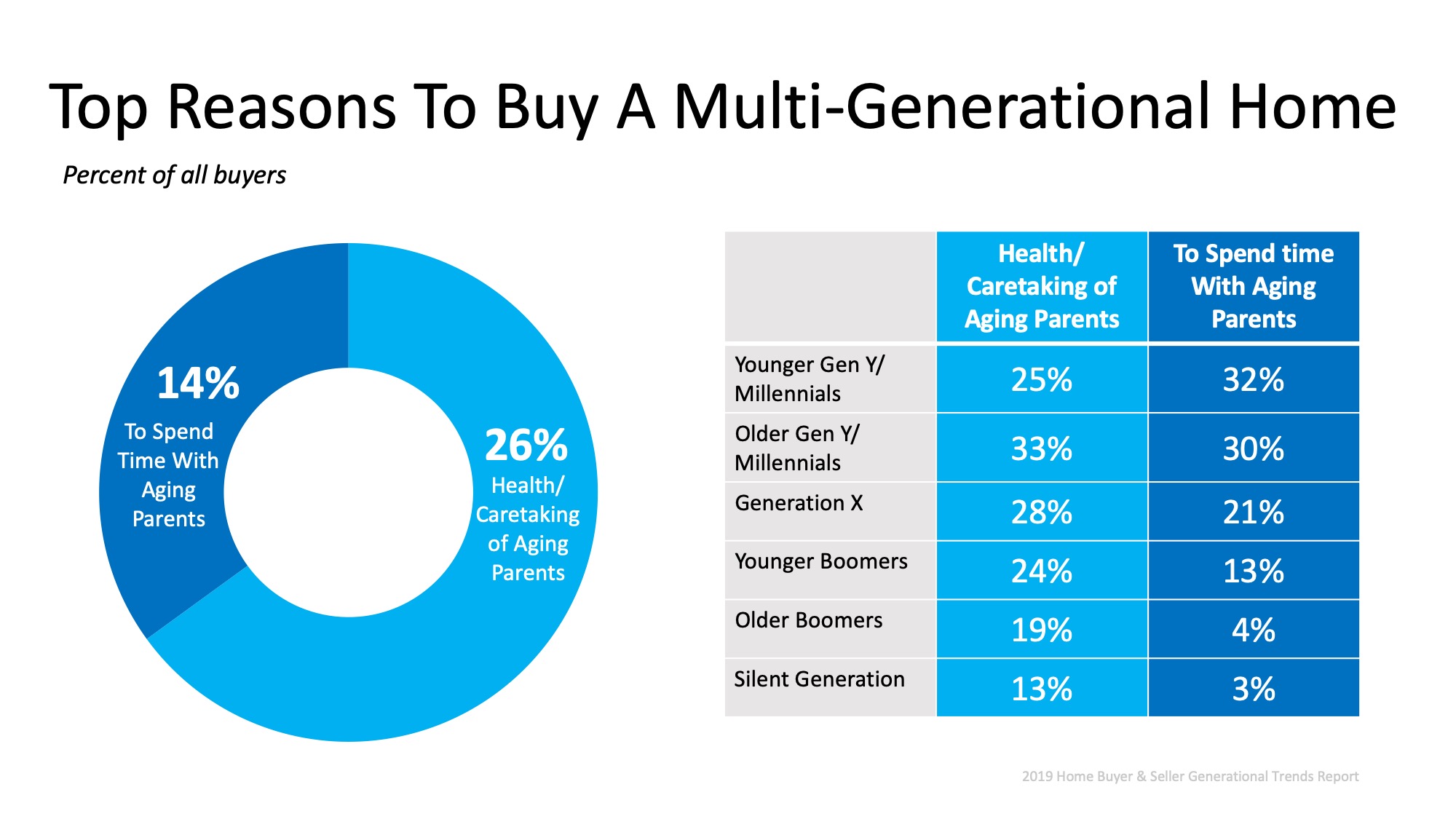

The graph below shows the number of people by generation that purchased a multigenerational home because they will either be taking care of an aging parent or they just want to spend time together. Of those buyers, 26% indicated they will be taking care of an aging parent, and 14% said they want to spend time with an aging parent. These numbers do not come as a surprise. According to Pew Research Center, 64 million Americans (20% of the population) lived in a multigenerational household in 2016 (Last numbers available).

Of those buyers, 26% indicated they will be taking care of an aging parent, and 14% said they want to spend time with an aging parent. These numbers do not come as a surprise. According to Pew Research Center, 64 million Americans (20% of the population) lived in a multigenerational household in 2016 (Last numbers available). An increasing number of studies affirm the benefits of being part of a multigenerational household. These benefits aren’t just for the grandchildren, but for the grandparents as well. According to these two resources:

An increasing number of studies affirm the benefits of being part of a multigenerational household. These benefits aren’t just for the grandchildren, but for the grandparents as well. According to these two resources:

“Children who are close to their grandparents have fewer emotional and behavioral problems and are better able to cope with traumatic life events, like a divorce or bullying at school”.

“Researchers found that emotionally close ties between grandparents and adult grandchildren reduced depressive symptoms in both groups”.

This research gives helpful insight into why 41% of Americans are in the market to buy a multigenerational home.

If you have a home that could accommodate a multigenerational family and are thinking about selling, now is the perfect time to put it on the market! The number of buyers looking for this type of home will only continue to increase.