What Happens to Housing when There’s a Recession?

Since the 2008 housing bubble burst, the word recession strikes a stronger emotional chord than it ever did before. And while there’s some debate around whether we’re officially in a recession right now, the good news is experts say a recession today would likely be mild and the economy would rebound quickly. As the 2022 CEO Outlook from KPMG says:

“Global CEOs see a ‘mild and short’ recession, yet optimistic about global economy over 3-year horizon . . .

More than 8 out of 10 anticipate a recession over the next 12 months, with more than half expecting it to be mild and short.”

To add to that sentiment, housing is typically one of the first sectors to rebound during a slowdown. As Ali Wolf, Chief Economist at Zonda, explains:

“Housing is traditionally one of the first sectors to slow as the economy shifts but is also one of the first to rebound.”

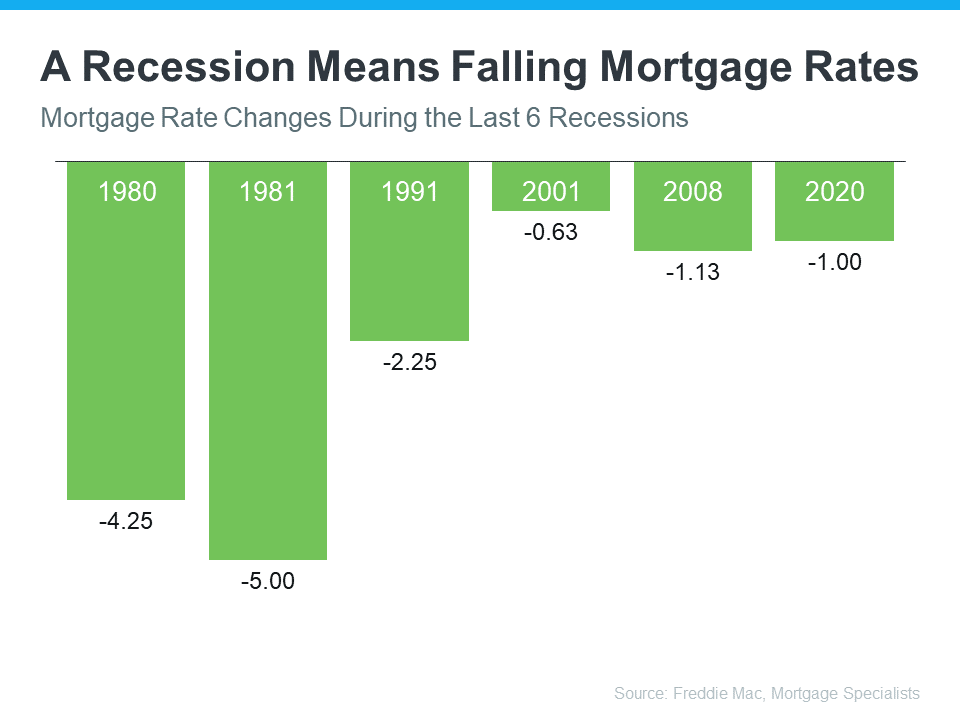

Part of that rebound is tied to what has historically happened to mortgage rates during recessions. Here’s a look back at rates during previous economic slowdowns to help put your mind at ease.

Mortgage Rates Typically Fall During Recessions

Historical data helps paint the picture of how a recession could impact the cost of financing a home. Looking at recessions in this country going all the way back to 1980, the graph below shows each time the economy slowed down mortgage rates decreased.

Fortune explains mortgage rates typically fall during an economic slowdown:

“Over the past five recessions, mortgage rates have fallen an average of 1.8 percentage points from the peak seen during the recession to the trough. And in many cases, they continued to fall after the fact as it takes some time to turn things around even when the recession is technically over.”

While history doesn’t always repeat itself, we can learn from and find comfort in the trends of what’s happened in the past. If you’re thinking about buying or selling a home, you can make the best decision by working with a trusted real estate professional. That way you have expert advice on what a recession could mean for the housing market.

Bottom Line

History shows you don’t need to fear the word recession when it comes to the housing market. If you have questions about what’s happening today, let’s connect so you have expert advice and insights you can trust.

What’s Ahead for Home Prices?

As the housing market cools in response to the dramatic rise in mortgage rates, home price appreciation is cooling as well. And if you’re following along with headlines in the media, you’re probably seeing a wide range of opinions calling for everything from falling home prices to ongoing appreciation. But what’s true? What’s most likely to happen moving forward?

While opinions differ, the most likely outcome is we’ll fall somewhere in the middle of slight appreciation and slight depreciation. Here’s a look at the latest expert projections so you have the best information possible today.

What the Experts Are Saying About Home Prices Next Year

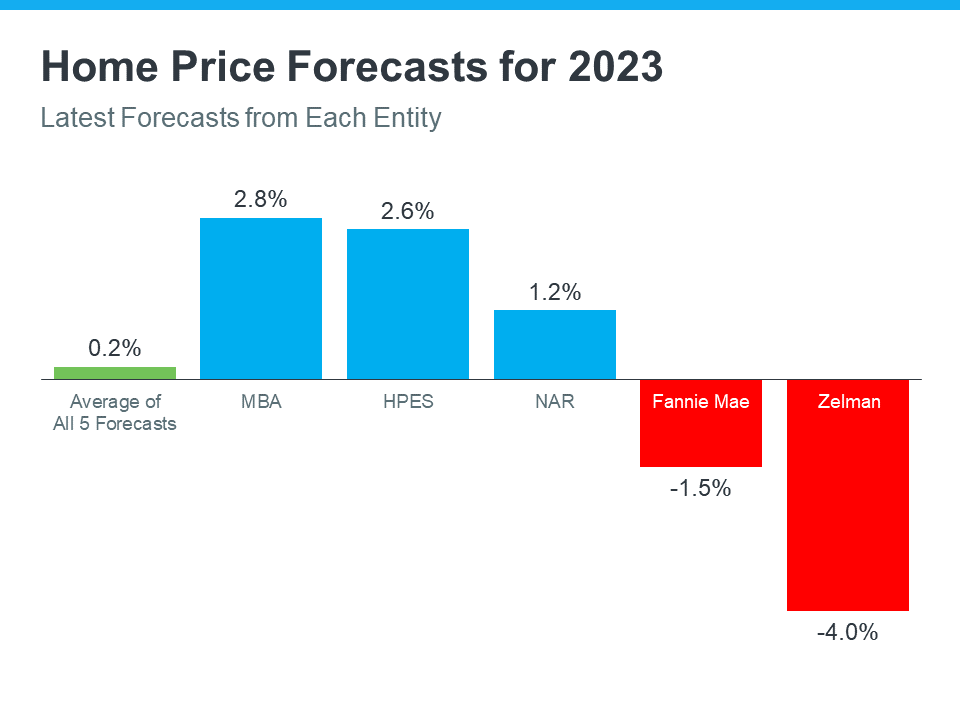

The graph below shows the most up-to-date forecasts from five experts in the housing industry. These are the experts that have most recently updated their projections based on current market trends:

As the graph shows, the three blue bars represent experts calling for ongoing home price appreciation, just at a more moderate rate than recent years. The red bars on the graph are experts calling for home price depreciation.

While there isn’t a clear consensus, if you take the average (shown in green) of all five of these forecasts, the most likely outcome is, nationally, home price appreciation will be fairly flat next year.

What Does This Mean?

Basically, experts are divided on what’s ahead for 2023. Home prices will likely depreciate slightly in some markets and will continue to gain ground in others. It all depends on the conditions in your local market, like how overheated that market was in recent years, current inventory levels, buyer demand, and more.

The good news is home prices are expected to return to more normal levels of appreciation rather quickly. The latest forecast from Wells Fargo shows that, while they feel prices will fall in 2023, they think prices will recover and net positive in 2024. That forecast calls for 3.1% appreciation in 2024, which is a number much more in line with the long-term average of 4% annual appreciation.

And the Home Price Expectation Survey (HPES) from Pulsenomics, a poll of over one hundred industry experts, also calls for ongoing appreciation of roughly 2.6 to 4% from 2024-2026. This goes to show, even if prices decline slightly next year, it’s not expected to be a lasting trend.

As Jason Lewris, Co-Founder and Chief Data Officer for Parcl, says:

“In the absence of trustworthy, up-to-date information, real estate decisions are increasingly being driven by fear, uncertainty, and doubt.”

Don’t let fear or uncertainty change your plans. If you’re unsure about where prices are headed or how to make sense of what’s going on in today’s housing market, reach out to a local real estate professional for the guidance you need each step of the way.

Bottom Line

The housing market is shifting, and it’s a confusing place right now. Let’s connect so you have a trusted real estate professional to help you make confident and informed decisions about what’s happening in our market.

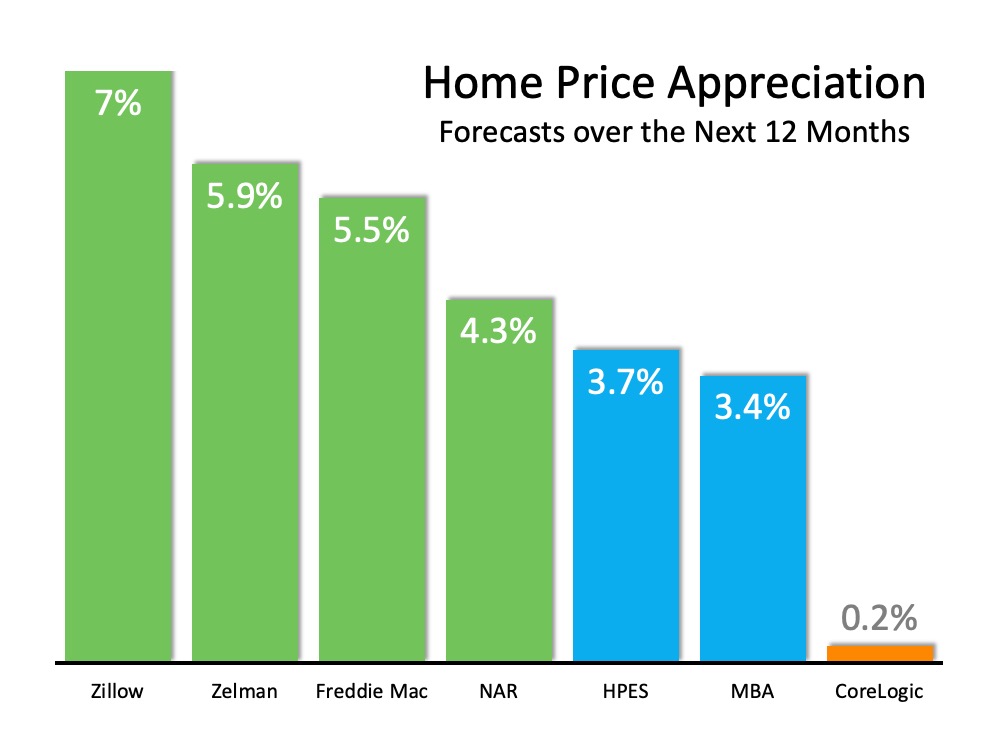

Home Values Projected to Keep Rising

As we enter the final months of 2020 and continue to work through the challenges this year has brought, some of us wonder what impact continued economic uncertainty could have on home prices. Looking at the big picture, the rules of supply and demand will give us the clearest idea of what is to come.

Due to the undersupply of homes on the market today, there’s upward pressure on prices. Consider simple economics: when there is high demand for an item and a low supply of it, consumers are willing to pay more for that item. That’s what’s happening in today’s real estate market. The housing supply shortage is also resulting in bidding wars, which will also drive price points higher in the home sale process.

There’s no evidence that buyer demand will wane. As a result, experts project price appreciation will continue over the next twelve months. Here’s a graph of the major forecasts released in the last 60 days:

I hear many foreclosures might be coming to the market soon. Won’t that drive prices down?

Some are concerned that homeowners who entered a mortgage forbearance plan might face foreclosure once their plan ends. However, when you analyze the data on those in forbearance, it’s clear the actual level of risk is quite low.

Ivy Zelman, CEO of Zelman & Associates and a highly-regarded expert in housing and housing-related industries, was very firm in a podcast last week:

“The likelihood of us having a foreclosure crisis again is about zero percent.”

With demand high, supply low, and little risk of a foreclosure crisis, home prices will continue to appreciate.

Bottom Line

Originally, many thought home prices would depreciate in 2020 due to the economic slowdown from the coronavirus. Instead, prices appreciated substantially. Over the next year, we will likely see home values rise even higher given the continued lack of inventory of homes for sale.

Is Now a Good Time to Move?

How long have you lived in your current home? If it’s been a while, you may be thinking about moving. According to the latest Profile of Home Buyers and Sellers by the National Association of Realtors (NAR), in 2019, homeowners were living in their homes for an average of 10 years. That’s a long time to time to be in one place, considering the average length of time homeowners used to stay put hovered closer to 6 years.

With today’s changing homebuyer needs, especially given how the current health crisis has altered our daily lifestyles, many homeowners are reconsidering where they’re at and thinking about moving to a home with more space for their families. Here’s why it might be a great time to make that happen.

The real estate market has changed in many ways over the past 10 years, and current homeowners are earning much more equity today than they used to have. According to CoreLogic, in the first quarter of 2020 alone, the average homeowner gained approximately $9,600 in equity. If you’re considering selling your house right now, you may have accumulated more equity to put toward a move than you realize.

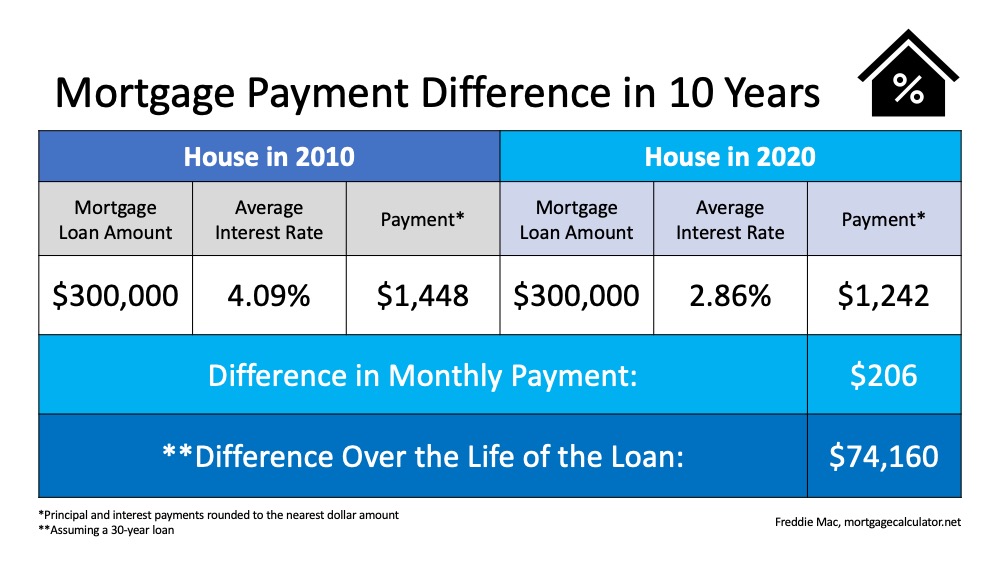

Dialing back 10 years, many homeowners also locked in a fairly low mortgage rate. In 2010, the average rate was only 4.09%. This motivated homeowners to stay in their houses longer than usual to keep their rate low, rather than moving. Just last Thursday, however, average mortgage rates hit a new historic low at 2.86%. Sam Khater, Chief Economist at Freddie Mac explains:

“Mortgage rates have hit another record low due to a late summer slowdown in the economic recovery…These low rates have ignited robust purchase demand activity, which is up twenty-five percent from a year ago and has been growing at double digit rates for four consecutive months.”

Ten years ago, we couldn’t have imagined a mortgage rate under 3%. Looking at the math today, making a move into a new home and locking in a significantly lower rate than you have now could save you greatly on a monthly basis, and over the life of your loan (See chart below): As the example shows, you can save a substantial amount every month if you qualify for today’s low mortgage rate, and the savings can really add up over the life of a 30-year fixed-rate loan.

As the example shows, you can save a substantial amount every month if you qualify for today’s low mortgage rate, and the savings can really add up over the life of a 30-year fixed-rate loan.

Bottom Line

As a homeowner, you have a huge opportunity to move up right now. Whether you want to save more each month or get more home for your money based on your family’s changing needs, it’s a great time to connect to discuss the market in our area. Buyers are actively looking for more homes to buy, and you can win big by making a move if the time is right for you.

It’s Not Just About the Price of the Home

When most of us begin searching for a home, we naturally start by looking at the price. It’s important, however, to closely consider what else impacts the purchase. It’s not just the price of the house that matters, but the overall cost in the long run. Today, that’s largely impacted by low mortgage rates. Low rates are actually making homes more affordable now than at any time since 2016, and here’s why.

Today’s low rates are off-setting rising home prices because it’s less expensive to borrow money. In essence, purchasing a home while mortgage rates are this low may save you significantly over the life of your home loan.

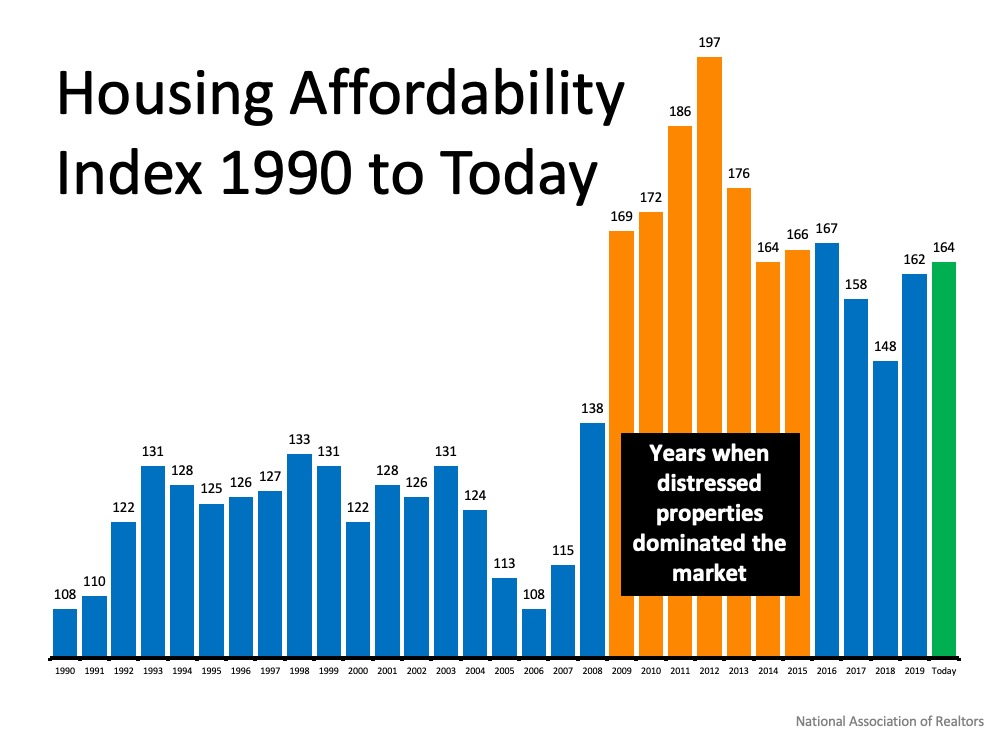

Taking a look at the graph below with data sourced from the National Association of Realtors (NAR), the higher the bars rise, the more affordable homes are. The orange bars represent the period of time when homes were most affordable, but that’s also reflective of when the housing bubble burst. At that time, distressed properties, like foreclosures and short sales, dominated the market. That’s a drastically different environment than what we have in the housing market now.

The green bar represents today’s market. It shows that homes truly are more affordable than they have been in years, and much more so than they were in the normal market that led up to the housing crash. Low mortgage rates are a big differentiator driving this affordability.

What are the experts saying about affordability?

Experts agree that this unique moment in time is making homes incredibly affordable for buyers.

Lawrence Yun, Chief Economist, NAR:

“Although housing prices have consistently moved higher, when the favorable mortgage rates are factored in, an overall home purchase was more affordable in 2020’s second quarter compared to one year ago.”

Bill Banfield, EVP of Capital Markets, Quicken Loans:

“No matter what you’re looking for, this is a great time to buy since the current low interest rates can stretch your spending power.”

“Those shopping for a home can afford 10 percent more home than they could have one year ago while keeping their monthly payment unchanged. This translates into nearly $32,000 more buying power.”

“Homeowners are the clear winners. Low mortgage rates mean the cost of owning is at historically low levels and who gains all the benefits of strong house price appreciation? Homeowners.”

Bottom Line

When purchasing a home, it’s important to think about the overall cost, not just the price of the house. Homes on your wish list may be more affordable today than you think. Let’s connect to discuss how affordability plays a role in our local market, and your long-term homeownership goals.