At one point or another, you’ve probably heard someone say, “Yesterday was the best time to buy a home, but the next best time is today.”

That’s because nationally, home values continue to rise. And with mortgage rates still stubbornly high and home prices going up, you may be holding out for prices to fall or trying to time the market for that perfect rate. But here’s the truth: waiting for the right moment could cost you in the long run.

Home Prices Are Still Rising – Just at a More Normal Pace

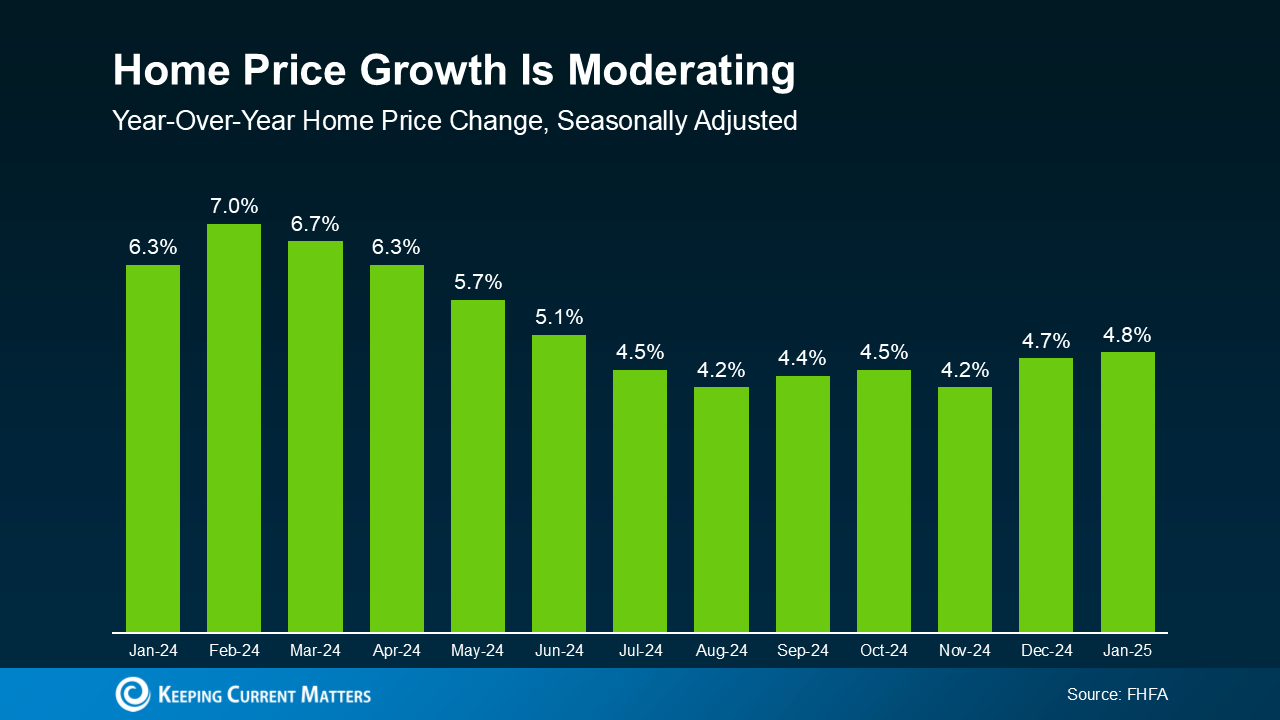

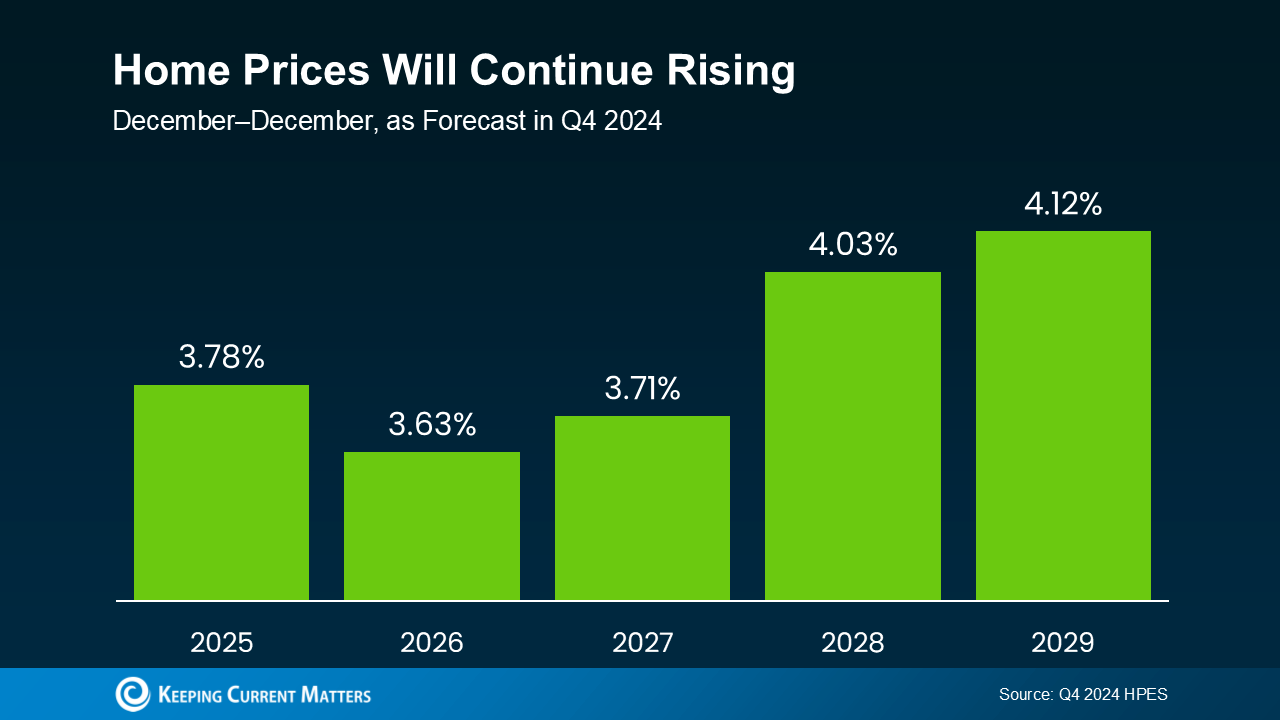

The idea that prices will drop dramatically is wishful thinking in most markets. According to the Home Price Expectations Survey from Fannie Mae, industry analysts are saying prices are projected to keep rising through at least 2029.

While we’re no longer seeing the steep spikes of previous years, experts project a steady and sustainable increase of around 3-4% per year, nationally. And the good news is, this is a much more normal pace – a welcome sign for hopeful buyers (see graph below):

What This Means for You

What This Means for You

While it’s tempting to wait it out for prices or mortgage rates to decline before you buy, here’s what you’ll need to consider if you do.

- Tomorrow’s home prices will be higher than today’s. The longer you wait, the more that purchase price will go up.

- Waiting for the perfect mortgage rate or a price drop may backfire. Even if rates dip slightly, rising home prices could still make waiting more expensive overall.

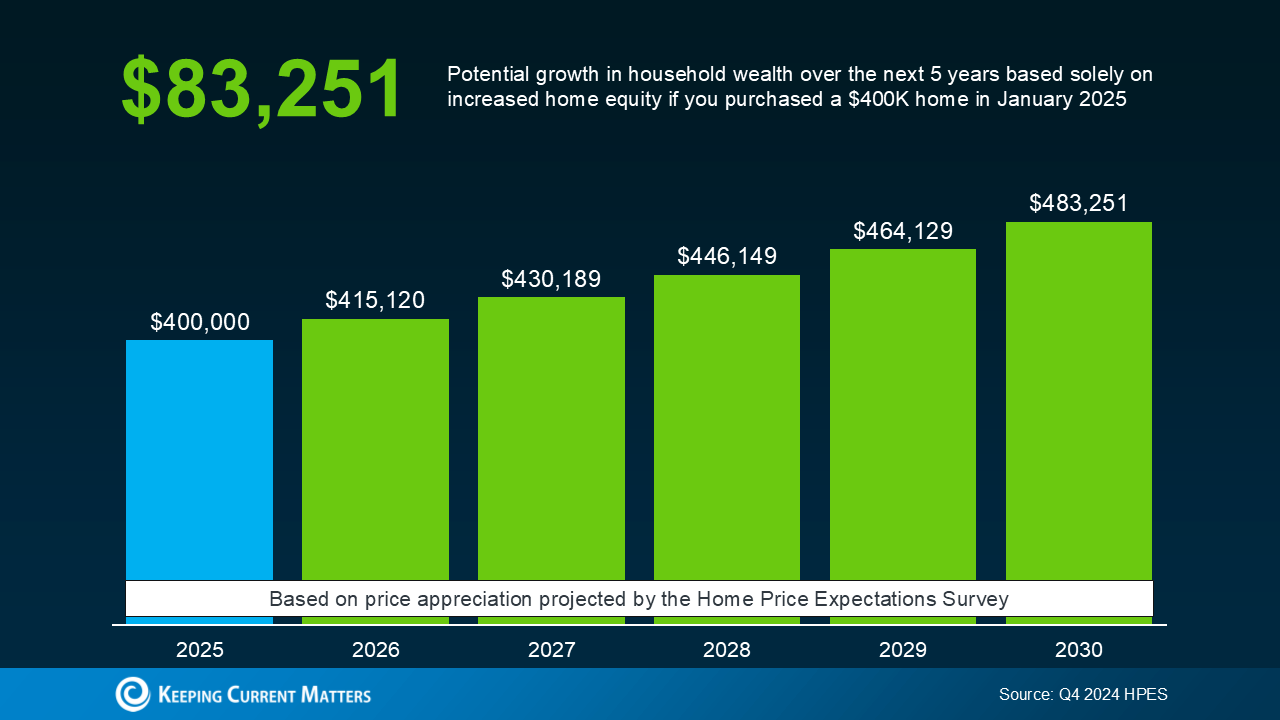

- Buying now means building equity sooner. Home values are rising, which means your investment starts growing as soon as you buy.

Let’s put real numbers into this equation. If you purchase a $400,000 home today, based on these price forecasts, it’s expected to go up in value by more than $83,000 over the next five years. That’s some serious money back in your pocket instead of being left on the sidelines (see graph below):

Why Aren’t Prices Dropping? It’s All About Supply and Demand

Why Aren’t Prices Dropping? It’s All About Supply and Demand

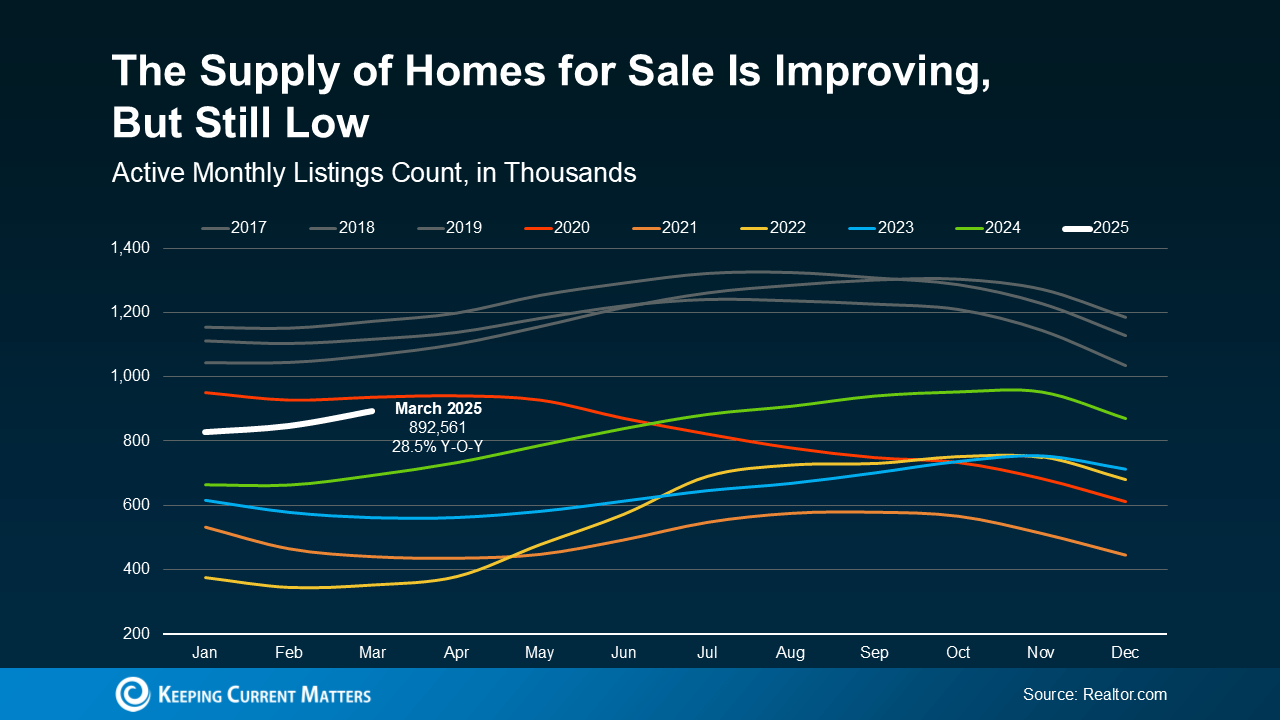

Even though there are more homes for sale right now than there were at this time last year, or even last month, there still aren’t enough of them on the market for all the buyers who want to purchase them. And that puts continued upward pressure on prices. As Redfin puts it:

“Prices will rise at a pace similar to that of the second half of 2024 because we don’t expect there to be enough new inventory to meet demand.”

While every market is different, most areas will continue to see moderate price growth. Some may level off a bit, but a major national drop? Not likely.

Bottom Line

Time in the Market Beats Timing the Market

If you’re debating whether to buy now or wait, remember this: real estate rewards those who get in the market, not those who try to time it perfectly.

Yes, today’s housing market has its challenges, but there are ways to make it work —exploring different neighborhoods, considering smaller condos or townhomes, asking your lender about alternative financing, or tapping into down payment assistance programs. The key is making a move when it makes sense for you rather than waiting for a perfect scenario that may never arrive.

Want to take a look at what’s happening with prices in your local market? Whether you’re ready to buy now or just exploring your options, reach out to a local agent so you have a plan in place that’ll set you up for success.

Lately, it feels like a lot of people have been asking the same question: “Is the housing market about to crash?”

Lately, it feels like a lot of people have been asking the same question: “Is the housing market about to crash?”