An Expert Gives You Clarity in Today’s Housing Market

The housing market has been going through shifts lately. That’s why it’s so important to work with an industry professional who can be your guide throughout the process.

A real estate expert uses their knowledge of what’s really happening with home prices, housing supply, expert projections, and more to give you the best advice. Someone who can provide clarity like that is critical right now. Jay Thompson, Real Estate Industry Consultant, explains:

“Housing market headlines are everywhere. Many are quite sensational, ending with exclamation points or predicting impending doom for the industry. Clickbait, the sensationalizing of headlines and content, has been an issue since the dawn of the internet, and housing news is not immune to it.”

Unfortunately, when information in the media isn’t clear, it can generate a lot of fear and uncertainty in the market. As Jason Lewris, Co-Founder and Chief Data Officer at Parcl, says:

“In the absence of trustworthy, up-to-date information, real estate decisions are increasingly being driven by fear, uncertainty, and doubt.”

But it doesn’t have to be that way. Buying a home is a big decision, and it should be one you feel confident making. You can lean on an expert to help you separate fact from fiction and get the answers you need.

The right agent can help you understand what’s happening at the national and local levels, and they can debunk headlines using data you can trust. Experts have in-depth knowledge of the industry and can provide context, so you know how current trends compare to the normal ebbs and flows in the industry, historical data, and more.

Then, to make sure you have the full picture, an agent can tell you if your local area is following the national trend or if they’re seeing something different in your market. Together, you can use all that information to make the best possible decision.

After all, making a move is a potentially life-changing milestone. It should be something you feel ready for and excited about. And that’s where a trusted expert comes in.

Leverage Your Equity When You Sell Your House

One of the benefits of being a homeowner is that you build equity over time. By selling your house, that equity can be used toward purchasing your next home. But before you can put it to use, you should understand exactly what equity is and how it grows. Bankrate explains it like this:

“Home equity is the portion of your home you’ve paid off – in other words, your stake in the property as opposed to the lender’s. In practical terms, home equity is the appraised value of your home minus any outstanding mortgage and loan balances.”

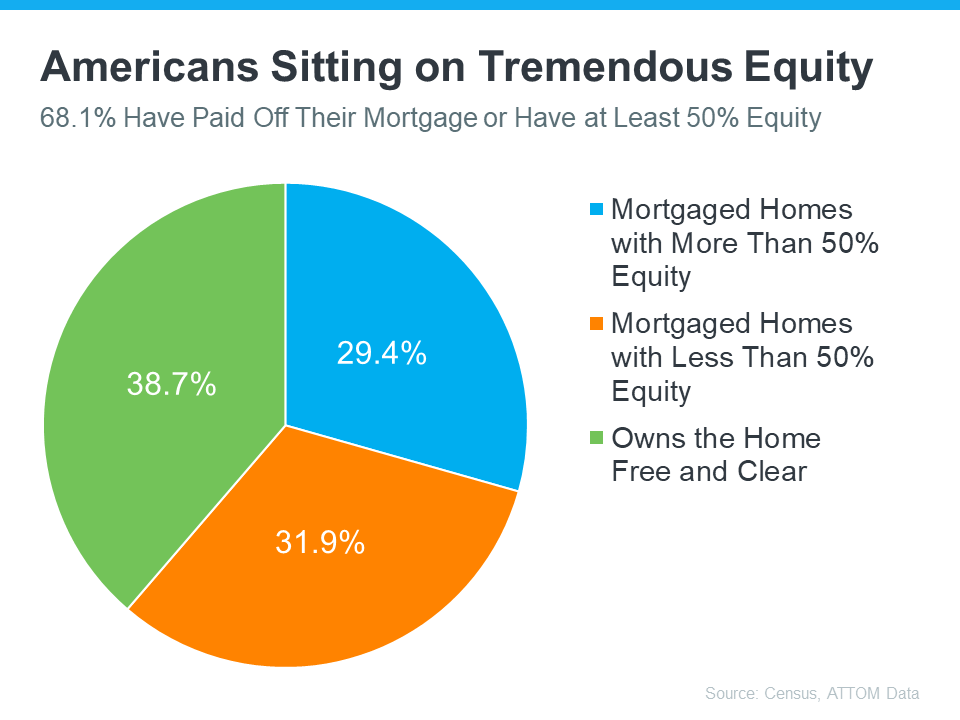

Majority of Americans Have a Large Amount of Equity

If you’ve owned your home for a while, you’ve likely built up some equity – and you may not even realize how much. Based on data from the U.S. Census Bureau and ATTOM, the majority of Americans have a substantial amount of equity right now (see graph below):

And having such large amounts of equity is a benefit to homeowners in more ways than one. Rick Sharga, Executive Vice President of Market Intelligence at ATTOM, explains:

“Record levels of home equity provide security for millions of families, and minimize the chance of another housing market crash like the one we saw in 2008.”

Over time, your home equity grows. In addition to providing financial stability while you own your house, when you’re ready to sell it, that money could go a long way toward paying for your next home.

2 Things Sellers Need To Know This Spring

A lot has changed over the past year, and you might be wondering what’s in store for the spring housing market. If you’re planning to sell your house this season, here’s what real estate experts are saying you should keep in mind.

1. Houses That Are Priced Right Are Still Selling

Houses that are updated and priced at their current market value are still selling. Jeff Tucker, Senior Economist at Zillow, says:

“. . . sellers who price and market their home competitively shouldn’t have a problem finding a buyer.”

The need to price your house right is so important today because the market has changed so much over the past year. Danielle Hale, Chief Economist at realtor.com, explains:

“With a smaller pool of buyers today and more competition from other homes on the market, homesellers will likely need to adjust their price expectations in the market this spring.”

While this spring housing market is different than last year’s, sellers with proper expectations who lean on a real estate expert for the best advice on pricing their house well are still finding success. And that’s great news if you’re thinking about selling.

2. Buyers Are Still Out There

As mortgage rates have risen and remain volatile, some buyers have pressed pause on their plans. But there are still plenty of reasons people are buying homes today. Lisa Sturtevant, Chief Economist at Bright MLS, spells out the mindset of today’s buyers:

“For some buyers, higher mortgage rates simply means buying a home is out of the question unless home prices fall. For others, higher mortgage rates will be a hurdle but ultimately will not keep them from getting back into the market after sitting on the sidelines for months.”

That’s why, if you’re interested in selling your house this spring, it’s helpful to work with a real estate agent who can help connect you with those buyers who are ready to purchase a home.

Where Will You Go After You Sell Your House? [INFOGRAPHIC]

Why You Shouldn’t Fear Today’s Foreclosure Headlines

If you’ve seen recent headlines about foreclosures surging in the housing market, you’re certainly not alone. There’s no doubt, the stories in the media can be pretty confusing right now. They may even make you think twice about buying a home for fear that prices could crash. The reality is, the data shows a foreclosure crisis is not where the market is headed, and understanding what that really means is mission critical if you want to know the truth about what’s happening today. Here’s a deeper look.

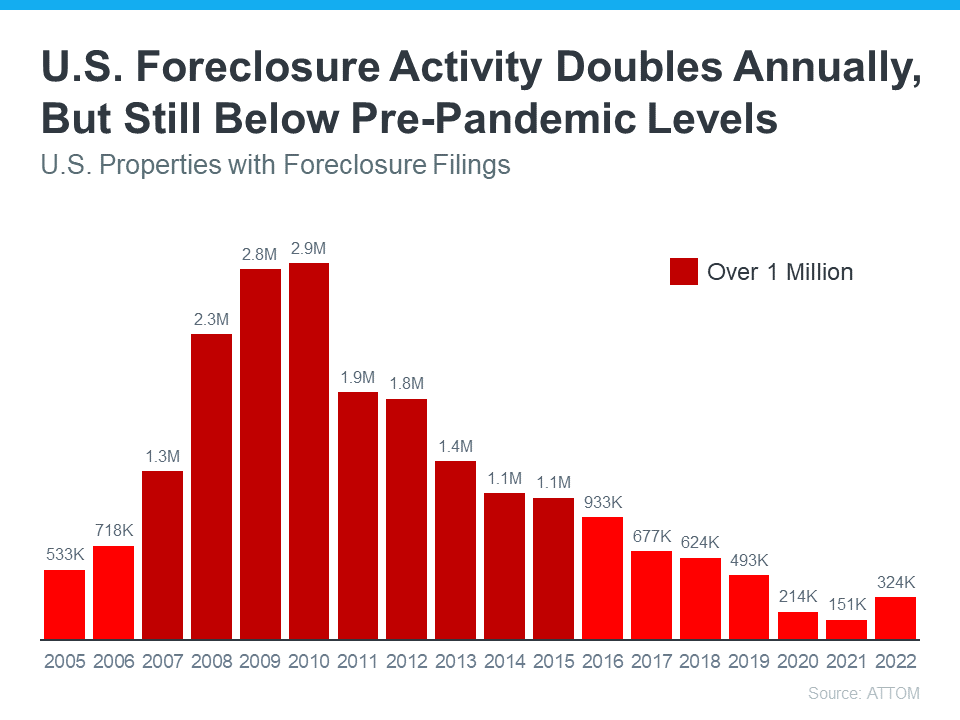

According to the Year-End 2022 U.S. Foreclosure Market Report from ATTOM, foreclosure filings are up 115% from 2021, but down 34% from 2019. As media headlines grab onto this 115% increase, it’s more important than ever to put that percentage into context.

While the number of foreclosure filings did more than double last year, we need to remember why that happened and how it compares to more normal, pre-pandemic years in the market. Thanks to the forbearance program and other relief options for homeowners, foreclosure filings were down to record-low levels in 2020 and 2021, so any increase last year is — no surprise — a jump up. Rick Sharga, Executive VP of Market Intelligence at ATTOM, notes:

“Eighteen months after the end of the government’s foreclosure moratorium, and with less than five percent of the 8.4 million borrowers who entered the CARES Act forbearance program remaining, foreclosure activity remains significantly lower than it was prior to the COVID-19 pandemic. It seems clear that government and mortgage industry efforts during the pandemic, coupled with a strong economy, have helped prevent millions of unnecessary foreclosures.”

Clearly, these options meant millions of homeowners could stay in their homes, allowing them to get back on their feet during a very challenging period. With home values rising at the same time, many homeowners who may have found themselves facing foreclosure under other circumstances were able to leverage their equity and sell their houses rather than face foreclosure, and that trend continues today.

And remember, as the graph below shows, foreclosures today are far below the record-high 2.9 million that were reported in 2010 when the housing market crashed.

So, while foreclosures are rising, keeping perspective in mind is key. As Bill McBride, Founder and Author of Calculated Risk, noted just last week:

“The bottom line is there will be an increase in foreclosures over the next year (from record low levels), but there will not be a huge wave of distressed sales as happened following the housing bubble. The distressed sales during the housing bust led to cascading price declines, and that will not happen this time.”

Bottom Line

Right now, putting the data into context is more important than ever. While the housing market is experiencing an expected rise in foreclosures, it’s nowhere near the crisis levels seen when the housing bubble burst, and that won’t lead to a crash in home prices.

![Where Will You Go After You Sell Your House? [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2023/03/02130847/Where-Will-You-Go-After-You-Sell-Your-House-MEM.png)